Structured Bonds Explained

Projects like BarnBridge, Hifi, Saffron and others are pooling liquidity to create structured bonds. With the exception of some short duration experimental products, fixed rate lending generally doesn’t exist in DeFi.

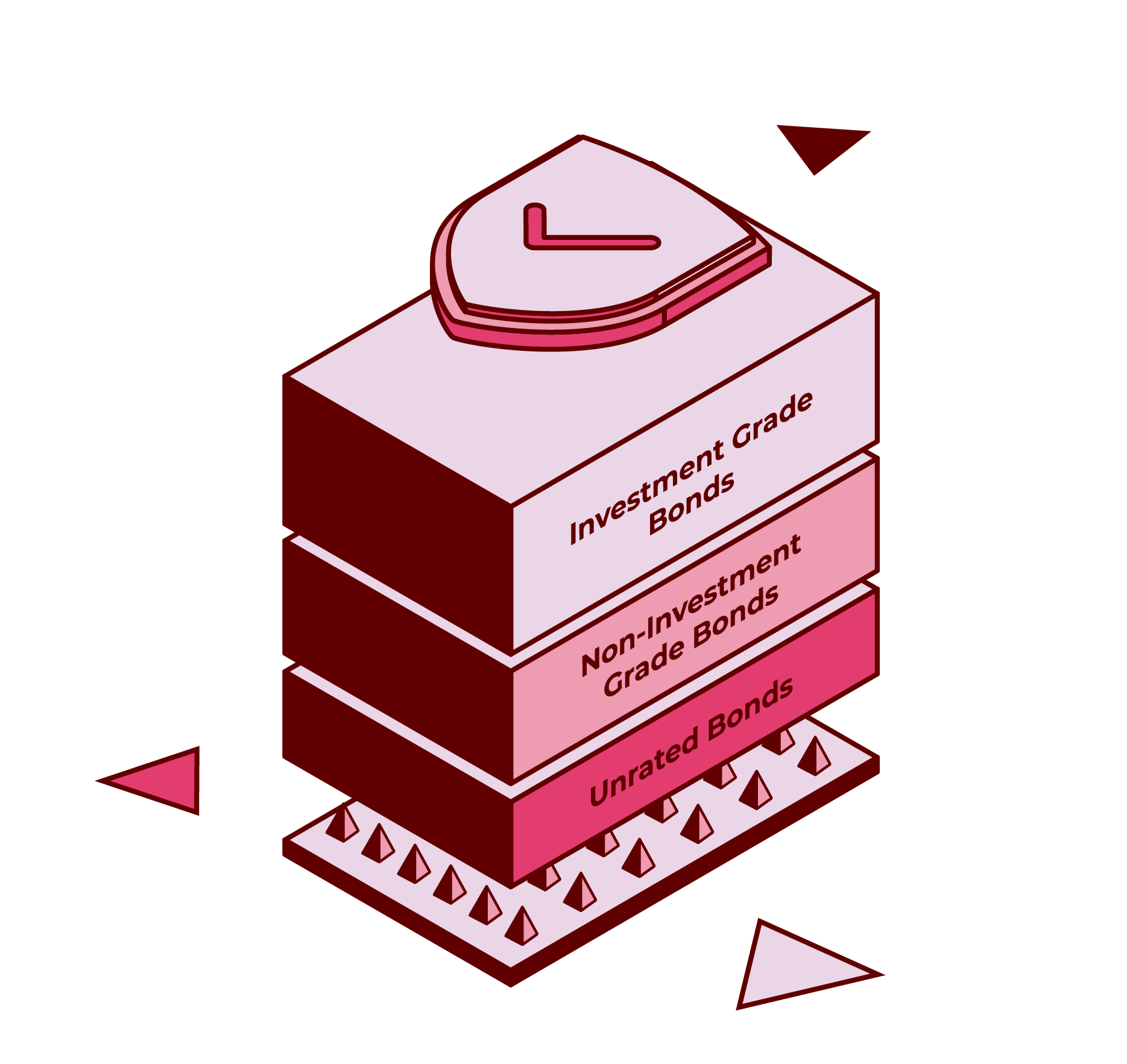

Tranching is the key concept and driving force behind these new protocols’ efforts to create fixed rate lending markets. Assuming a stablecoin liquidity pool, it’s possible to carve the pool into 2 (or more) tranches. Let’s assume the tranches are split at 70/30 with 70 being the fixed rate senior piece and 30 the variable rate junior. The overall pool of stablecoin is invested in other variable rate lending protocols (Aave, Compound), earning yield. Due to the yield of the overall pool (plus potentially protocol tokens), the ability to create term and fixed rates presents itself. For example, the 70% (senior) tranche can be given a maturity and a fixed rate. The 30% (junior) tranche can have a variable, but potentially higher rate of return. In exchange for this higher return, the 30% tranche takes the risk of losing principal, as it is used to ensure that the 70% tranche pays off, in full, by a certain maturity date.